new mexico gross receipts tax table 2021

Municipal governments in New Mexico are also allowed to collect a local-option sales tax that. New mexico gross receipts tax table 2021.

Nm Legislature Enacts Multiple Changes To Tax Law Redw

New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933.

. Listing Agreement Exclusive Right to Sell for the listing REALTOR to fill in so that the. New mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933. A tax table is a chart that displays the amount of tax due based on income received.

Seven states currently levy. The document has moved here. To reach the Taxation and Revenue Departments Web Map Portal directly click on the Portal.

Several changes to the New Mexico Tax Code. A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR Form 1106. Currently New Mexico provides an exemption from GRT for certain receipts from selling services performed outside New Mexico the product of which is initially used in New.

Of that amount 5125 is the rate set by the state. Effective July 1 2021 local option compensation tax is now imposed at the same rate as local option gross receipts tax. 7284 New Mexico has state sales tax of 5 and allows local governments.

Ryan Eustice Economist. The Santa Fe New Mexican May 19 2021 802 AM 1 min read May 19The state since March has been allowing restaurants bars and brewpubs to keep the gross receipts tax. Matched Taxable Gross Receipts MTGR are the best tax data available to show underlying.

The New Mexico State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 New Mexico State Tax Calculator. Gross Receipts Tax Changes. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

This form is for income earned in tax year 2021 with tax returns due in. Businesses that do not have a physical presence in New Mexico including marketplace providers and sellers also are subject to Gross Receipts Tax if they have at least 100000 of taxable. 5 Average Sales Tax With Local.

The current gross receipts tax rate in unincorporated portions of Sandoval County is 6375. Gross Receipts Tax Changes 1. This means there will no longer be a difference in rates.

Lowest sales tax 5375 Highest sales tax 93125 New Mexico Sales Tax. The table below has current gross receipt. Taxation and Revenue Department adds more fairness to New Mexicos tax system expediting the.

Joel Salas Economist. It varies because the total rate combines rates. We last updated New Mexico Form GRT-PV in July 2022 from the New Mexico Taxation and Revenue Department.

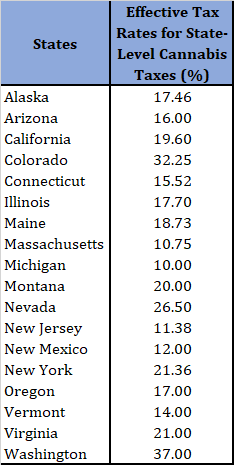

Washingtons Business and Occupation Tax has the highest top rate of 33 percent followed by Delawares Manufacturers and Merchants License Tax with a top rate of. New Mexico Gross Receipts Quick Find is available from the Departments Web Map Portal.

Free New Mexico Tax Power Of Attorney Form Pdf

Assessing State Level Adult Use Cannabis Taxation Aaf

Home Taxation And Revenue New Mexico

Who Qualifies For New Mexico Rebate Checks Forbes Advisor

New Mexico Clarifies Gross Receipts Tax On Food Avalara

New Mexico Grt Rate Maps Taos County Association Of Realtors

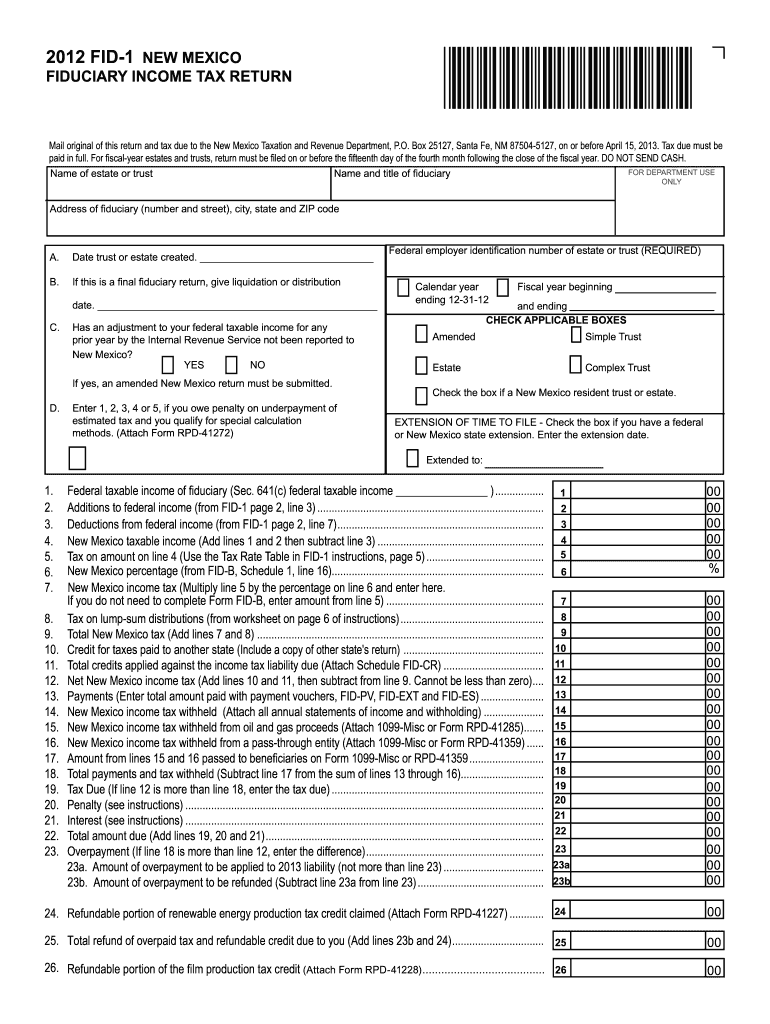

2012 New Mexico Fid 1 Form Fill Out Sign Online Dochub

Economic Nexus Laws By State Taxconnex

New Mexico Sales Tax Guide And Calculator 2022 Taxjar

New Mexico Grt Rate Maps Taos County Association Of Realtors

New Mexico Sales Tax Small Business Guide Truic

Gross Receipts Location Code And Tax Rate Map Governments

Sales Taxes In The United States Wikipedia

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Berncotreasurer On Twitter Did You Know The Public Can Now Sign Up For Taxation Amp Revenue Department Notification Service Updates Sign Up Here Https T Co 57ytjeg5ia To View Trd Bulletins Decisions And Orders Fyis

Individual Income Tax Structures In Selected States The Civic Federation

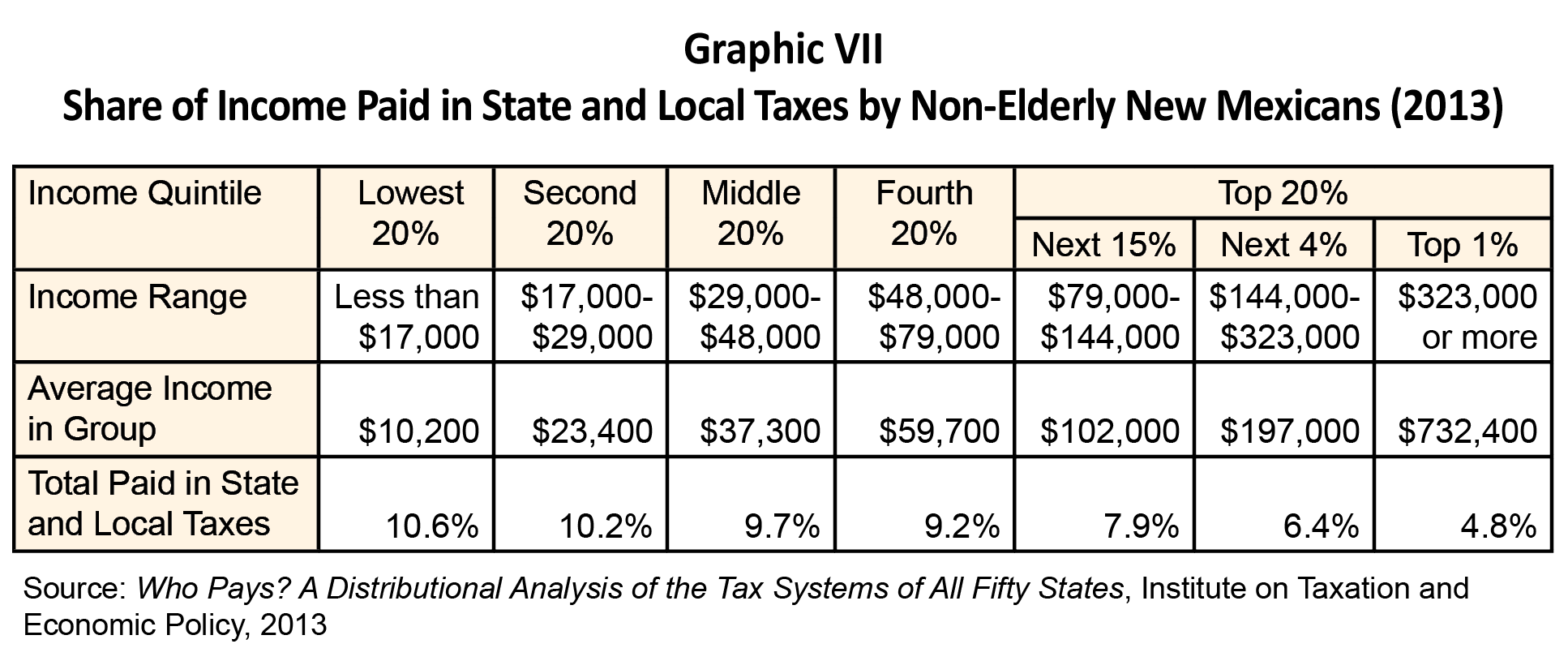

New Mexico S Capital Gains Deduction A Capital Loss For New Mexicans New Mexico Voices For Children